When air travel hit the skids in 2020, rental car companies struggled right alongside airlines and airports. With business slowing to a trickle, rental fleets were decimated by the sale of dormant vehicles. Hertz reported a 40% reduction in cars between the end of 2019 and the end of 2020.

When air travel hit the skids in 2020, rental car companies struggled right alongside airlines and airports. With business slowing to a trickle, rental fleets were decimated by the sale of dormant vehicles. Hertz reported a 40% reduction in cars between the end of 2019 and the end of 2020.

Although “car-sharing” services Turo and Avail have been around since 2009 and 2018, respectively, the COVID-19 paradigm shift is making them more viable competitors for traditional rental agencies such as Hertz, Avis and Enterprise. In general, Turo and Avail haven’t taken as hard of a hit during the pandemic travel slump because they mobilize privately owned vehicles rather than bearing the costs of maintaining their own fleets. Some call the model “Airbnb for cars” or “peer-to-peer vehicle rental” since it’s more commerce than sharing.

Regardless of the nomenclature, airports are a logical place for these services to operate due to their ready pool of business and leisure travelers needing ground transportation.

|

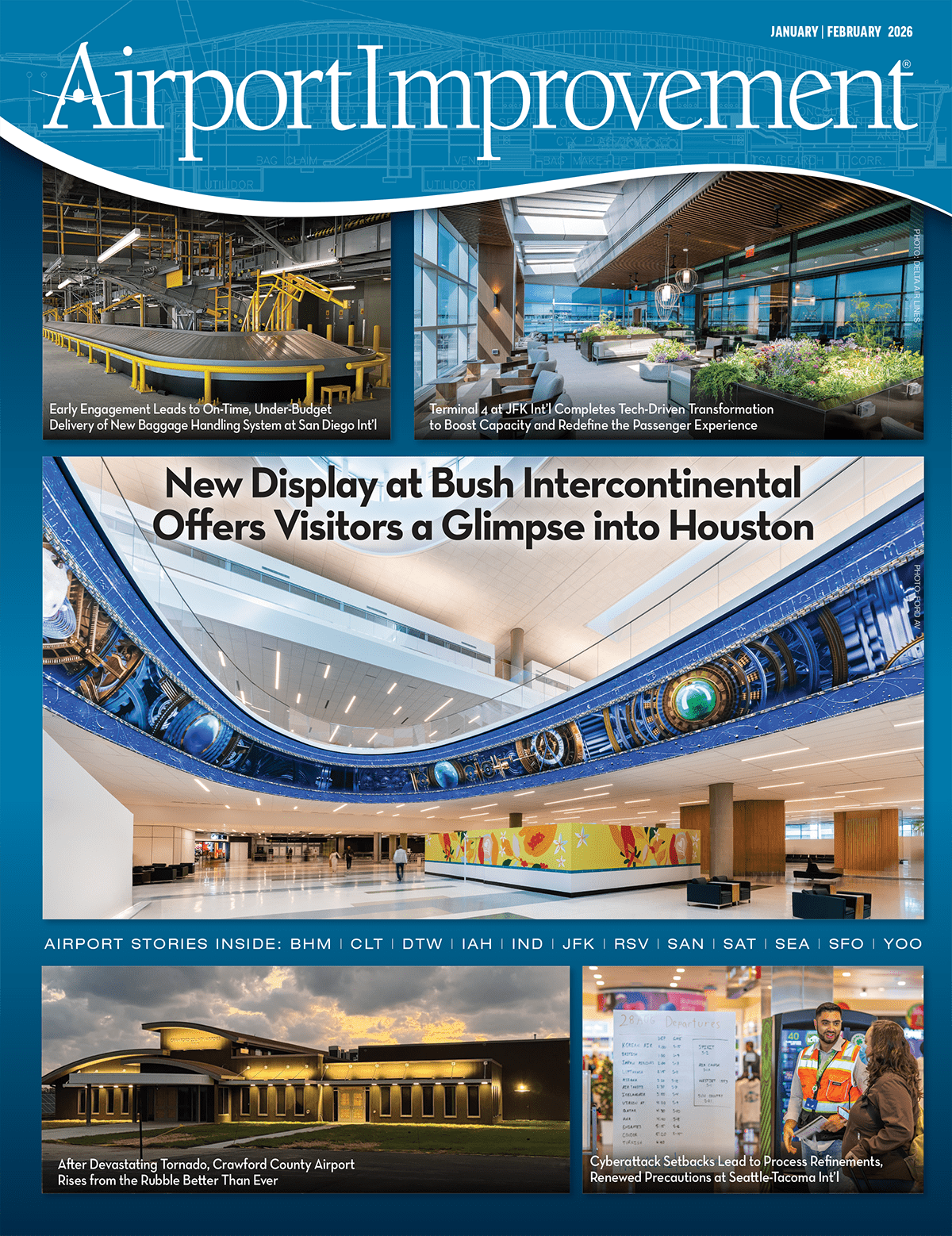

Project: Car-Sharing Service Agreements Location: Charlotte (NC) Douglas Int’l Airport Vendors: Turo; Avail Agreement Highlights: Each vendor pays 10% of its gross revenue from airport business & receives 49 covered parking spaces to conduct deliveries/pickups. If vendor’s car owners need 50 or more spaces, it pays airport $5 per space & 5% of gross revenues (same percentage as traditional rental agencies) Primary Benefits: Provides passengers with additional ground transportation option; establishes efficient operating processes; develops new revenue stream; ensures equity for other ground transportation providers |

When Charlotte Douglas International (CLT) discovered that Turo was starting to pick up business in its long-term parking lots, the team reached out to the firm to establish a protocol. That was three years ago, and the two organizations reached an operating agreement this spring (more details to follow). Avail, which is owned by insurance giant Allstate, started working with CLT’s business team this year to set up a contract for its car owners and operates under the same terms.

“Avail is a car-sharing service that uses underutilized assets–personal cars–to get them on the road and put dollars back in folks’ pockets,” says Alex David, the company’s business operations director. “When you look at the ecosystem of airports, it seems like a good match. People pay for their cars to be parked and collect dust, so we thought it was a good opportunity to take what is typically a cost—parking, rideshare, public transport, for instance—and make money.”

Needless to say, many airports feel threatened by the prospect of peer-to-peer car sharing/rental companies targeting their crucial revenue stream from onsite parking, not to mention the business of their rental agency tenants. And some are taking legal action.

In April 2020, an injunction went into effect that prevents Turo from operating at Boston Logan International Airport (BOS). The injunction resulted from a lawsuit filed in 2019 by the Massachusetts Port Authority (Massport), which owns and operates BOS.

Per the injunction, vehicle owners associated with the company are prohibited from picking up or dropping off vehicles anywhere at BOS or its properties, including roadways, terminal curbsides and parking lots. Moreover, they aren’t permitted to travel on airport roadways to pick up or drop off vehicles, or to list the airport as their home location.

Turo instructs car owners who operate under its purview to disable BOS as a delivery option for customers and urges them to honor the injunction while the company appeals the court’s decision. In the meantime, Turo provides car owners, whom it refers to as “hosts,” with a link they can share with their “guests” to help find nearby delivery locations.

It’s just the kind of standoff CLT wanted to avoid.

“As a federally-funded facility we have obligations to make the airport open and available to companies who want to do business here,” says CLT Chief Business and Innovation Officer Theodore Kaplan. “When a company approaches us and says it wants to have a business at the airport, we strive to negotiate acceptable terms,” says Kaplan. “Turo is a service our guests are interested in using, and we want to find outlets for all of the interests of our passengers. It’s yet another option for them to have access to a vehicle.”

“As a federally-funded facility we have obligations to make the airport open and available to companies who want to do business here,” says CLT Chief Business and Innovation Officer Theodore Kaplan. “When a company approaches us and says it wants to have a business at the airport, we strive to negotiate acceptable terms,” says Kaplan. “Turo is a service our guests are interested in using, and we want to find outlets for all of the interests of our passengers. It’s yet another option for them to have access to a vehicle.”

Kaplan considers accommodating car-sharing services a new opportunity to earn revenue in different ways, and likens them to transportation network companies (TNCs) such as Lyft and Uber. When demand for the app-based ride-hailing services began to bloom, airports had to devise ways to protect their interests and cover associated costs while also facilitating a new ground transportation option that was quickly becoming a favorite for some passengers. That wasn’t always easy, but airports rose to the challenge. Today, many designate special areas for ride-hailing/TNC drop-offs and pickups to eliminate associated curbside congestion and other operational strains.

From a revenue standpoint, transportation to and from airports is a major business. Taxis, shuttles and TNCs are all priced differently, with separate agreements to operate on airport campuses. The agreement CLT established with Turo requires it to lease parking spaces for vehicle delivery/pickup and/or pay a percentage of the revenue that originates or ends at the airport.

“TNCs like Uber and Lyft are charged by the trip,” explains Donovan Jones, the airport’s business and relationship manager. “With Turo, it’s a unique situation. They are leasing 49 spaces in our Express Deck 2 parking deck, and the company pays per transaction.”

Collaborative Approach

Collaborative Approach

“This is a new line of business for us,” says Jones. “We came into an agreement in May, and we’re working out how to enforce this agreement. All activity by Turo’s hosts should take place within the [parking] deck, and it’s currently an honor system. We’re still in the process of trying to figure out how to track the activity.”

As part of the new agreement, the airport does receive a report of how many transactions Turo vehicles have had, and Jones can compare that to activity on the designated parking deck. Jones notes that geofencing works well for TNCs, but that’s currently not an option for car-sharing services due to the costs for them to set up software for car owners.

At CLT, rental car companies pay the airport 10% of the gross revenue from business conducted there. In contrast, TNCs are charged per-trip fees of $3.25 each. For Turo, the airport proposed a hybrid solution: If the company leases fewer than 50 parking spaces for vehicle delivery/pickup, it pays a flat 10% of gross revenue. If its car owners need 50 or more spaces, Turo pays $5 per space, per day, plus 5% of gross revenue.

Turo accepted CLT’s hybrid format and signed a one-year agreement that auto renews at its conclusion.

Kaplan notes that the company had already dealt with other airports when CLT proposed its plan. “Turo understood they needed to collaborate with us in order to be here,” he explains. “Once we got them started, it was a negotiation and we got to a mutually acceptable space.”

Give and Take

According to AAA’s Leisure Travel Index, average daily car rental rates have nearly doubled since 2020. Examples pulled for the popular July 4th weekend showed the average U.S. rate of $89 per day in 2020 increased to $166 in 2021. Rental rates at airports in select markets are skyrocketing to $250 or more per day.

Prices like that inspire many customers to seek alternative arrangements and create an open lane for companies like Turo and Avail.

Sean Mayo, director of airport partnerships for Turo, reports that sky-high rental car prices and the resurgence in air travel is causing business to boom for its car hosts. “Turo is uniquely positioned to alleviate the rental car crunch, because we leverage existing, underutilized cars,” he adds. “It is a much more efficient model that provides a win-win for both guests in need of a car and hosts looking to earn extra income.”

The vast majority of Avail’s business is based in airports, and that’s where the company is focusing its attention. When a passenger rents through Avail, the fee includes $1 million of insurance coverage from Allstate and no charge for a second driver. As the company’s business operations director, David boils it down to convenience and value. “We aim to be an affordable player in the space, and you’ll find our prices are lower,” he says. “Especially now after lockdown, people are being met by exorbitant rental car rates. We’re very transparent and upfront about our all-in prices.”

The vast majority of Avail’s business is based in airports, and that’s where the company is focusing its attention. When a passenger rents through Avail, the fee includes $1 million of insurance coverage from Allstate and no charge for a second driver. As the company’s business operations director, David boils it down to convenience and value. “We aim to be an affordable player in the space, and you’ll find our prices are lower,” he says. “Especially now after lockdown, people are being met by exorbitant rental car rates. We’re very transparent and upfront about our all-in prices.”

David notes that CLT understands the benefits that car sharing provides consumers and emphasizes its benefits for outbound passengers: “When you think of a family of five who wants to go on a vacation, and they’re parking for $10, $15, or $20 per day, Avail is a good value that includes insurance. It makes traveling out of CLT that much more affordable.”

Mayo also highlights the potential for mutual benefits. “Being able to work with airports like CLT represents a huge step in increasing consumer choice and allows companies, like Turo, to help generate revenue for the airport,” he explains. “This partnership signals that CLT is a pioneer in welcoming innovation and new technology. We are eager to work with CLT and are hopeful that this is a sign of things to come.”

Speaking from the airport’s perspective, Kaplan predicts that new rental options such as Turo and Avail will grow in many markets and consequently considers the topic an industry-wide issue.

To be sure, CLT and BOS are not the only airports wrestling with the issue. Legal action has occurred regarding Turo operations at several airports, including Tampa International, Los Angeles International and San Francisco International. While each case is different, there are common themes. Airport operators often argue that traffic from Turo adds to curbside congestion and the company should sign agreements, follow operating rules and pay fees like traditional car rental agencies to help cover costs associated with them operating on airport property. Turo generally argues that it’s not a rental company because it connects private vehicle owners and renters via an app rather than owning its own fleet, and it doesn’t affect airport infrastructure the same way rental companies do. It also cites the importance of competitive choices for consumers.

“Airports are trying to figure out how to regulate car-sharing businesses operating at their facilities,” Kaplan observes. “If they are making money off an airport without paying their share, that wouldn’t be fair to everyone else. It has been a new process for airports, and we’ve been playing catch-up. [At CLT), we like to be a good partner to all of our vendors.”

facts&figures

facts&figures