Despite a pair of Texas-sized setbacks, McKinney National Airport (TKI) recently unveiled nearly $17 million of improvements to boost service for corporate travelers flocking into the booming Dallas Metroplex through its facilities. The McKinney Air Center came online in September and immediately wowed visitors with its two-story grand lobby, natural lighting and first-class fixtures.

Despite a pair of Texas-sized setbacks, McKinney National Airport (TKI) recently unveiled nearly $17 million of improvements to boost service for corporate travelers flocking into the booming Dallas Metroplex through its facilities.

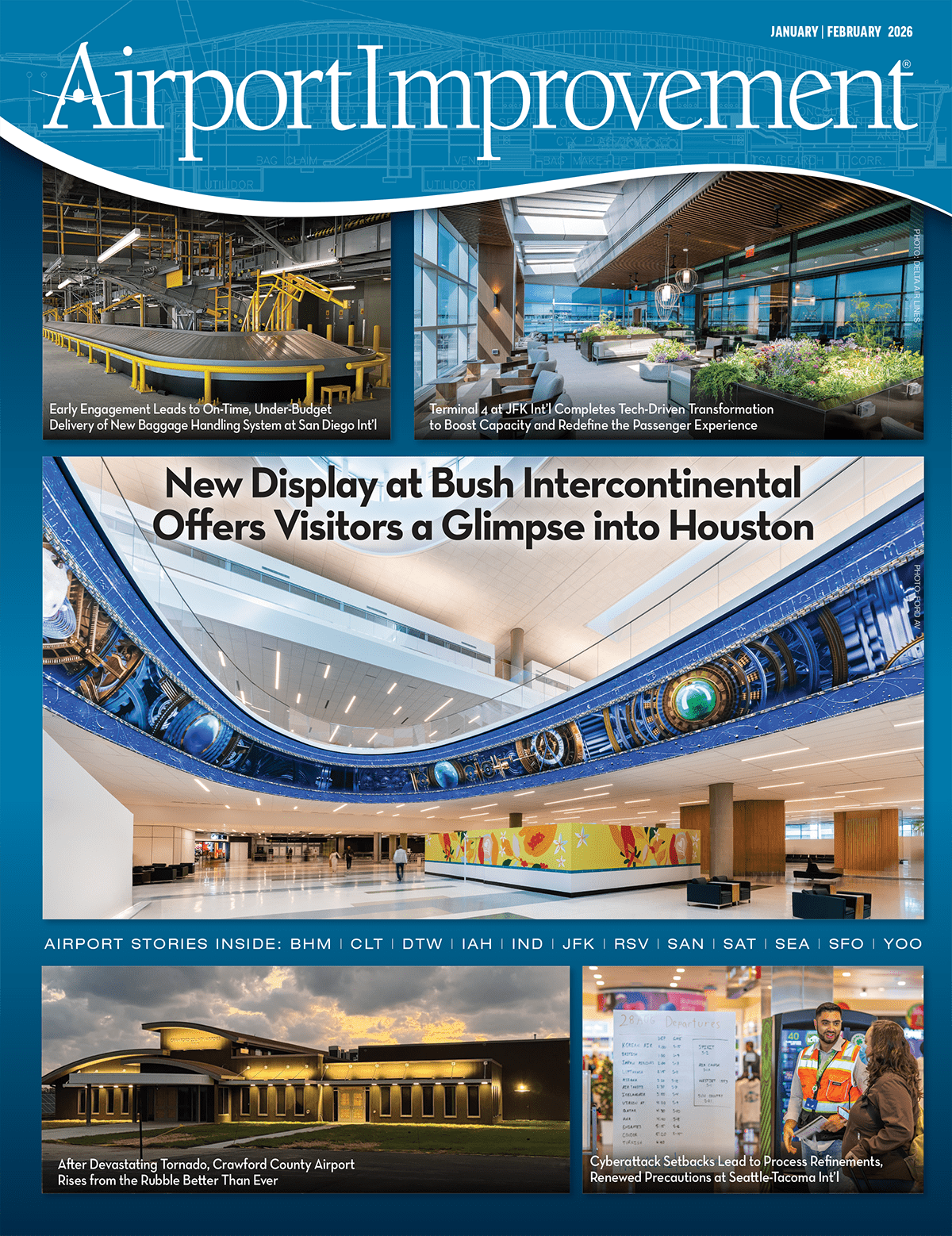

The McKinney Air Center came online in September and immediately wowed visitors with its two-story grand lobby, natural lighting and first-class fixtures. The 17,000-square-foot general aviation terminal houses conference and office spaces; crew lounge and flight prep areas; a bar and a community meeting room. There’s also a new 40,000-square-foot hangar farther south on the airfield.

The McKinney Air Center came online in September and immediately wowed visitors with its two-story grand lobby, natural lighting and first-class fixtures. The 17,000-square-foot general aviation terminal houses conference and office spaces; crew lounge and flight prep areas; a bar and a community meeting room. There’s also a new 40,000-square-foot hangar farther south on the airfield.

Until recently, some questioned whether the terminal would, in fact, get off the ground. Back-to-back bankruptcies from a pair of general contractors delayed construction by nearly 18 months, though Airport Director Kenneth Carley says those difficulties only made the opening more satisfying for TKI passengers, tenants and staff.

“Although we’ve had to wait a lot longer to bring the facility online, it blows me away how beautiful it is, inside and out,” Carley remarks.

|

Project: New General Aviation Terminal Location: McKinney (TX) National Airport Facility: McKinney Air Center Size: 2 stories, 17,000 sq. ft. Adjacent Hangar: 40,000 sq. ft. Cost: $16.8 million Designer: CaCo Architecture Contractor: Nicholson Management Co. Airport Size: 780 acres 2022 Operations: 145,777 Sole Runway: 7,500 ft. long, 150 ft. wide (2024 project will add another 500 ft. of length) Airport Owner: City of McKinney, TX Airline Impact Study: InterVISTAS Consulting Potential Future Projects: Commercial terminal; on-site fire station; 60,000-gallon fuel farm; new parallel taxiway |

Temporarily Grounded

The city of McKinney has owned TKI since the airport opened in 1979. Ten years ago, it purchased the fixed-base operator (FBO) and fueling rights from a private developer. A strategic plan identified shortcomings, including aging facilities. First on the list of improvements: a larger general aviation terminal and a new hangar.

A request for proposals led to a public-private partnership with Western LLC. Crews broke ground in April 2018, and a 40,000-square-foot hangar opened 12 months later. In September 2019, Western began erecting the terminal’s steel framework, though progress quickly ground to a halt.

Carley explains that with roughly $10 million spent, Western recognized it could not deliver the custom-designed building it had promised with its remaining budget. Attempts at value engineering and obtaining additional loans failed, and Western filed for bankruptcy in spring 2020.

Barry Shelton, an assistant city manager in McKinney, began working with the airport around the time of Western’s failure, which he terms “messy.” An apparently simple Plan B arose when the city issued new debt and turned the job over to the runner-up from its initial search. McRight-Smith Construction began work in April 2021, though it ultimately suffered the same fate as Western. This time, pandemic-driven supply chain problems and cost increases tipped the scales.

By June 2022, McRight-Smith Construction had also filed for bankruptcy. Progress at TKI was once again frozen.

“It’s never easy as a staff member to go to the city council and say a project has gone belly up,” Shelton recalls. “But they understood we had a partially constructed terminal building. If we were to pull out, not only would we have lost out on the positive aspects of the project, but we’d also have the negative aspect of an unfinished construction site sitting right there in the center field of the airport.”

When the city took over following Western’s demise, it required McRight-Smith to obtain performance and payment bonds for the project. Lexon Insurance Company, a member company of global insurer Sompo International, issued the requisite performance and payment bonds. After McRight-Smith went under, a demand was made on those bonds, and Nicholson Professional Consulting was hired to investigate the claim. It then called upon Nicholson Management Co., an affiliated construction management firm that works almost exclusively on surety cases.“Roads, bridges, airports, schools…we’re pretty well-versed in any type of construction project you can think of,” says Mason Fleming, a Nicholson project executive.

When the city took over following Western’s demise, it required McRight-Smith to obtain performance and payment bonds for the project. Lexon Insurance Company, a member company of global insurer Sompo International, issued the requisite performance and payment bonds. After McRight-Smith went under, a demand was made on those bonds, and Nicholson Professional Consulting was hired to investigate the claim. It then called upon Nicholson Management Co., an affiliated construction management firm that works almost exclusively on surety cases.“Roads, bridges, airports, schools…we’re pretty well-versed in any type of construction project you can think of,” says Mason Fleming, a Nicholson project executive.

Construction at TKI resumed in December 2022, and the terminal was completed nine months later, though the task wasn’t easy. Beyond deciding which of its predecessors’ subcontractors to keep on the job—and settling up with those that were still owed money—Nicholson also contended with damages on a worksite left idle for months. Exposed ductwork was moldy and had to be replaced, and steel beams impacted by weather needed remediation.

“There were a number of things in each stage of the project where it kind of went backwards a step before it could go forward,” Carley says. “[Nicholson’s team] is very good at stepping into a very difficult situation and making things work.”

First up was finishing the terminal’s roof structure to make the building weathertight. Then, crews evaluated leftover mechanical, electrical and plumbing systems to determine what was needed to finish the job.

“You take a freeze-frame of where it’s at, look at the immediately preceding steps to where work currently is, and most of the time you can pick it right back up,” explains Fleming.

Nicholson retained 75% to 80% of the subcontractors working under McRight-Smith, and Fleming characterizes the overall work his firm inherited as solidly performed. The subcontractors hadn’t been negligent; the primary contractor simply ran out of money, he explains. Once the project was finished, Fleming says a sense of pride and accomplishment permeated all involved.

“The end-users had to watch this building go through various stages over a three-year period,” he relates. “To be able to give them something they can use, that they love and is beautiful…that’s awesome. That’s what it’s all about.”

Gone To Texas

McKinney has slightly more than 210,000 residents. Located 30 miles north of downtown Dallas, the city bills itself as “Unique by Nature,” balancing small-town life on tree-lined streets with a vibrant downtown that attracts tourists with nightlife, dining and entertainment. The mix of down-home culture and proximity to a major metro area is attracting new faces—and places—in droves.

“Collin County is one of the fastest-growing counties in the country,” Shelton advises. “The population growth is tremendous, and with that, hand-in-hand, is the corporate growth.”

“Collin County is one of the fastest-growing counties in the country,” Shelton advises. “The population growth is tremendous, and with that, hand-in-hand, is the corporate growth.”

Indeed, the corporate stars are big and bright deep in the heart of McKinney. Two years ago, Raytheon opened a 200,000-square-foot Advanced Integration and Manufacturing Center facility within its existing Space and Airborne Systems headquarters. The defense conglomerate was already McKinney’s largest employer with 3,000+ workers, and the new intelligent manufacturing facility created 500 more jobs.

Cirrus Aircraft broke ground this spring on a $13 million, 45,000-square-foot complex at TKI that will include two hangars, eight shade canopies and flight simulators; 50 employees work at its McKinney flight training and maintenance facility. Farther south, JP Morgan/Chase and Liberty Mutual recently opened separate complexes in Plano, each spanning more than 1 million square feet. Frito-Lay and J.C. Penney are also based in Plano, as is Toyota’s North American headquarters, which relocated from California in 2017.

To the west in Frisco is the corporate base of Conifer Health Solutions, a nationwide medical care management firm. Frisco is also home to the $1.5 billion practice facility and self-proclaimed “world headquarters” of the NFL Dallas Cowboys.

Although he won’t name other names, Carley says the Fortune 500 is well represented at TKI. “On any given day, you might see a Cirrus SR22 parked next to a Gulfstream G550,” he says. “Our base customers are the biggest corporations in manufacturing, insurance, construction, microchips…you name it.”

Even before its recent improvements, TKI met the expectations of well-heeled clients for years and recently ranked in the Top 10 of the 2023 Aviation International News FBO survey. “Now we’re finally at the point where the facility mimics the (level of) service that we’ve offered,” Carley remarks.

The posh new McKinney Air Center, designed by Dallas-based CaCo Architecture, features regional limestone and wood-clad ceilings. The firm’s other aviation projects include the Terminal 2W renovation at Dallas Fort Worth International Airport (DFW) and the new Southwest Airlines cargo, provisioning and ground service equipment compound at Dallas Love Field (DAL).

TKI has 30 employees, more than 400,000 square feet of hangar space and a healthy $15 million annual operating budget. Shelton notes that the only other nearby FBOs, located in the town of Addison, are at an airport that is landlocked and lacks space to build more amenities. This makes TKI the only game in town for additional corporate clientele—and perhaps someday for an entirely different pool of aviation customers.

Two’s Company, Three’s a Crowd (for Now)

The Dallas Metroplex already has the world’s second-busiest commercial airport in DFW, the primary hub for American Airlines, and also enjoys robust domestic service downtown at DAL, where Southwest Airlines was born and continues to call home. Both are an hour drive from McKinney, however, and many believe Collin County’s rapid growth could eventually lead to commercial service at TKI.

In fact, Carley reports that multiple air carriers have made unsolicited inquiries about the prospect of such an opportunity. A study by InterVISTAS Consulting released last year projects that commercial service would bring more than 3,200 new jobs and $850 million in yearly economic output to the region once TKI reaches 533,000 annual enplanements.

In an attempt to develop a commercial terminal at TKI, McKinney’s City Council placed a $200 million bond package on the ballot this May. Had it been approved, the city-backed debt would have covered two-thirds of the cost of a 144,000-square-foot facility on the east side of the airfield. Plans called for four gates initially, with room to add a dozen more.

More federal, state and local funds would be needed to break ground on a $300 million terminal to complement DFW and DAL. Also discussed were an on-airport fire station, a fuel farm with two 30,000-gallon tanks and a new parallel taxiway that would push the commercial terminal’s cost to nearly $350 million—and that doesn’t include the Texas Department of Transportation’s proposed off-airport highway spur to be built just south of TKI.

Despite a potential economic windfall from construction activity and expanded airport services, the ballot measure failed. Nearly 60% of Collin County voters rejected the bond issuance, effectively grounding TKI’s commercial terminal in the near future.

“We’re now working with city council on what options we would have to move forward, whether it’s other financing or a partnership deal,” Shelton says. “Because of the growth in the county and the region, and McKinney being positioned where it is, I think [commercial airline service] is bound to happen if the options presented prove to be favorable.”

Carley remains undeterred. “We may look at a smaller plan to prove the concept, getting an airline in here by building just what we need for Day One,” he explains. “I don’t think the prospect of commercial service here is dead at all.”

Until that changes, TKI will continue incentivizing general aviation customers away from nearby airfields by promising fewer delays, superior infrastructure and service geared specifically for private aircraft. Another 40,000-square-foot hangar is in design, and a new U.S. Customs and Border Protection facility will soon be built, Carley says.

Before the city took over the FBO, it was only 60% occupied and TKI received subsidies of up to $800,000 a year from the city’s general fund. Today, the airport is fully leased, pays its own way and needs more leasable space to meet customer demand.

A 2018 study commissioned by the state of Texas indicated that TKI had an annual economic impact of $213 million, and Carley is confident that figure underrepresents the airport’s true value today. He estimates there are at least 100 more on-airport jobs compared to five years ago and cites tens of millions of dollars in capital investments.

Carley credits McKinney’s elected leaders for continuing to support TKI—major construction delays and all. “We’re blessed with a city council that understands the return on investment,” he says. “They’re very bullish on the airport and understand what they’re getting…They’re not shy, and it’s paid off.”

facts&figures

facts&figures