El Paso, TX, is mounting a comeback as a key U.S. manufacturing hub, and El Paso International Airport (ELP) is leading the charge.

El Paso, TX, is mounting a comeback as a key U.S. manufacturing hub, and El Paso International Airport (ELP) is leading the charge.

With broad community support, ELP has launched an ambitious industrialization strategy to give the region an economic boost and address challenges facing the region and nation at large. The area’s well-trained workforce wants better jobs close to home; while separately, the Pentagon broadly seeks onshore access to strategic components necessary to build and maintain America’s military and aerospace inventories.

“The United States is in huge trouble right now. We have a diminishing manufacturing sector that poses a serious threat to our defense capabilities,” says Dr. Ahsan Choudhuri of the University of Texas at El Paso (UTEP), a key advocate for ELP’s business diversification push.

“Manufacturing left the United States through El Paso. It will come back to the United States through El Paso,” Choudhuri adds with convincing optimism.

|

facts&figures

Projects: Innovation Factory; Advanced Manufacturing Location: El Paso (TX) Int’l Airport Key Goals: Help small- to mid-sized manufacturing businesses access contracts in aerospace & defense industries; attract well-paying jobs to West Texas Innovation Factory Size: 30,000 sq. ft. Cost: $1.9 million Design: In*Situ Architecture Construction: Noble General Contractors Timeline: Completed in late 2022

Advanced Manufacturing Size: 250 acres Cost: $31.2 million for initial 3-building complex with 250,000 sq. ft. of space Funding: $25 million federal grant; $6.2 million in airport matching funds Note: Owner’s rep will be selected in mid-2023; first buildings are slated to open in late 2024 Key Benefits: Create job opportunities, enabling region to retain a larger share of skilled workers who graduate from its university programs; help existing local manufacturers pursue opportunities to supply U.S. aerospace and defense contractors |

The community is using federal legislation—and a related $25 million federal award—to create jobs and opportunities through innovative on-airport developments. Ironically, it was other federal legislation nearly three decades ago that wreaked havoc on the historic manufacturing region in the first place.

The momentum already seems to be shifting, as years of work are coming to fruition just east of ELP’s runways. In late 2022, the airport converted nearly 30,000 square feet within an existing cargo building into a $1.9 million “Innovation Factory.” The aptly dubbed facility has private and shared spaces that will let entrepreneurs and small businesses incubate and manufacture industrial products for commercial use. Tenants are expected to begin arriving later this spring.

Over the next two years, ELP will also design and break ground on a 250-acre Advanced Manufacturing and Design Center capable of supporting full-scale, low- to medium-volume manufacturing operations. The airport will spend $31.2 million in a mix of federal and airport funds to kick start the site with 250,000 square feet of space in a three-building complex slated to open its first phases in late 2024.

By aiming small, ELP hopes to win big—for El Paso and the United States.

“We could go after companies like Lockheed (Martin Corp.), for example, but getting those large companies to come to the region is very hard,” says ELP Aviation Director Sam Rodriguez. “So instead, you focus on the smaller suppliers of Boeing, of Lockheed, of Raytheon, to be able to grow these groups and get them into an environment where they can bid on (defense industry) work.”

The federal grant ELP received is going to help it move up the timeline for the development of these industries in the region by years, he adds.

Military Might, Made in America

The U.S. Department of Defense has identified several factors threatening America’s industrial base, particularly given COVID-19’s ongoing disruptions to global supply chains. Escalating frictions with China and in Europe, rising shipping costs plus general decreases in workforce availability and manufacturing skills in the United States are all worrisome factors.

Choudhuri is chairman and professor of Mechanical Engineering and director of the Center for Space Exploration Technology Research, a NASA University Research Center. He says that for years, the University of Texas at El Paso has churned out a steady stream of talented graduates with aerospace and defense research experience, only to see them move elsewhere because jobs in their fields aren’t abundant in El Paso.

“You cannot build all the opportunities into a few American cities and think our country is going to be OK,” Choudhuri says, noting that hundreds of aerospace and engineering graduates from the University of Texas at El Paso now live in the Dallas Metroplex, and many work at Lockheed Martin’s Air Force Plant 4—the epicenter of the F-35 fighter jet program.

“You cannot build all the opportunities into a few American cities and think our country is going to be OK,” Choudhuri says, noting that hundreds of aerospace and engineering graduates from the University of Texas at El Paso now live in the Dallas Metroplex, and many work at Lockheed Martin’s Air Force Plant 4—the epicenter of the F-35 fighter jet program.

Choudhuri explains defense manufacturing must occur within the United States, or through select allied countries, so parts can be traceable and replenished without risk of foreign dependency during times of war. Trade secrets must also be safeguarded to ensure weapons and other key systems remain effective, he adds.

“When we start to lose our (national) manufacturing base, it has a humongous impact on overall capability, with a disproportionate impact on defense manufacturing,” Choudhuri cautions. “Even a simple plastic component for a missile defense system—you cannot go somewhere else and bring it here.”

Led by the local university, ELP is part of a regional group known as the West Texas Aerospace and Defense Manufacturing Coalition. Its goal: to use facilities at ELP to attract and assist entrants to aerospace and defense industries, simultaneously boosting the region’s workforce and manufacturing prowess.

Choudhuri notes that while small and medium businesses comprise the “backbone of American manufacturing capability,” they often lack access to the necessary infrastructure to grow, or sometimes even to bid on defense contracts. Co-locating in a centralized space fosters economies of scale by trimming costs for back-office support, environmental management and product design, among other, often prohibitive line items.

“To get into the defense supply chain, the cybersecurity is so big, a 20-person company simply cannot afford it, despite its manufacturing capability,” Choudhuri says. “Our objective (for ELP’s Innovation Factory and Advanced Manufacturing & Design Center) is to provide all the infrastructure as a service, the same way you’d provide the internet or electricity.

“The little guys now have a chance,” he explains.

Elizabeth Triggs, director of Economic and International Development for the city of El Paso, describes the community’s airport-centric approach to development as “unique and innovative.” The strategy focuses on the region’s three competitive advantages: expertise in building infrastructure; highly regarded work in advanced manufacturing and applied research from the University of Texas at El Paso; and plenty of wide-open spaces.

Elizabeth Triggs, director of Economic and International Development for the city of El Paso, describes the community’s airport-centric approach to development as “unique and innovative.” The strategy focuses on the region’s three competitive advantages: expertise in building infrastructure; highly regarded work in advanced manufacturing and applied research from the University of Texas at El Paso; and plenty of wide-open spaces.

“We own a lot of land,” Triggs says. “And a lot of that land is at the airport.”

Situated squarely in the Sun Belt, ELP is also developing two solar projects to offset its power needs through renewable energy. The airport will soon cover roughly 2.5 acres of short-term parking with solar panels that double as shade structures for vehicles. It’s expected to generate 1.5 megawatts of power annually. Rep. Veronica Escobar helped secure more than $1.7 million for the improvement as part of the December 2022 passage of the Consolidated Appropriations Act.

A separate project is in the works with a local utility, El Paso Electric, to create a 40-acre solar farm northeast of Runway 8R-26L. Once online, the micro grid is expected to provide 5 megawatts per year—enough to support the airport’s needs while also returning excess power for use by other city departments.

Beyond abundant sunshine for solar projects, ELP has a strategic location for aerospace- and defense-related work due to its proximity to the U.S. Army’s Fort Bliss, White Sands Missile Range and Holloman Air Force Base. There’s also significant nearby investment in private aerospace development, notably Virgin Galactic’s Spaceport America, just 100 miles to the north over the New Mexico state line.

So far, the West Texas Aerospace and Defense Manufacturing Coalition has identified about 300 local, small to medium manufacturers that employ anywhere from four to 100 people as key prospects for the new development at ELP. One company is already working on parts for hypersonic missile systems. Work is now underway with approximately 40 of those small businesses to potentially relocate to ELP and begin seeking work in the aerospace and defense sectors.

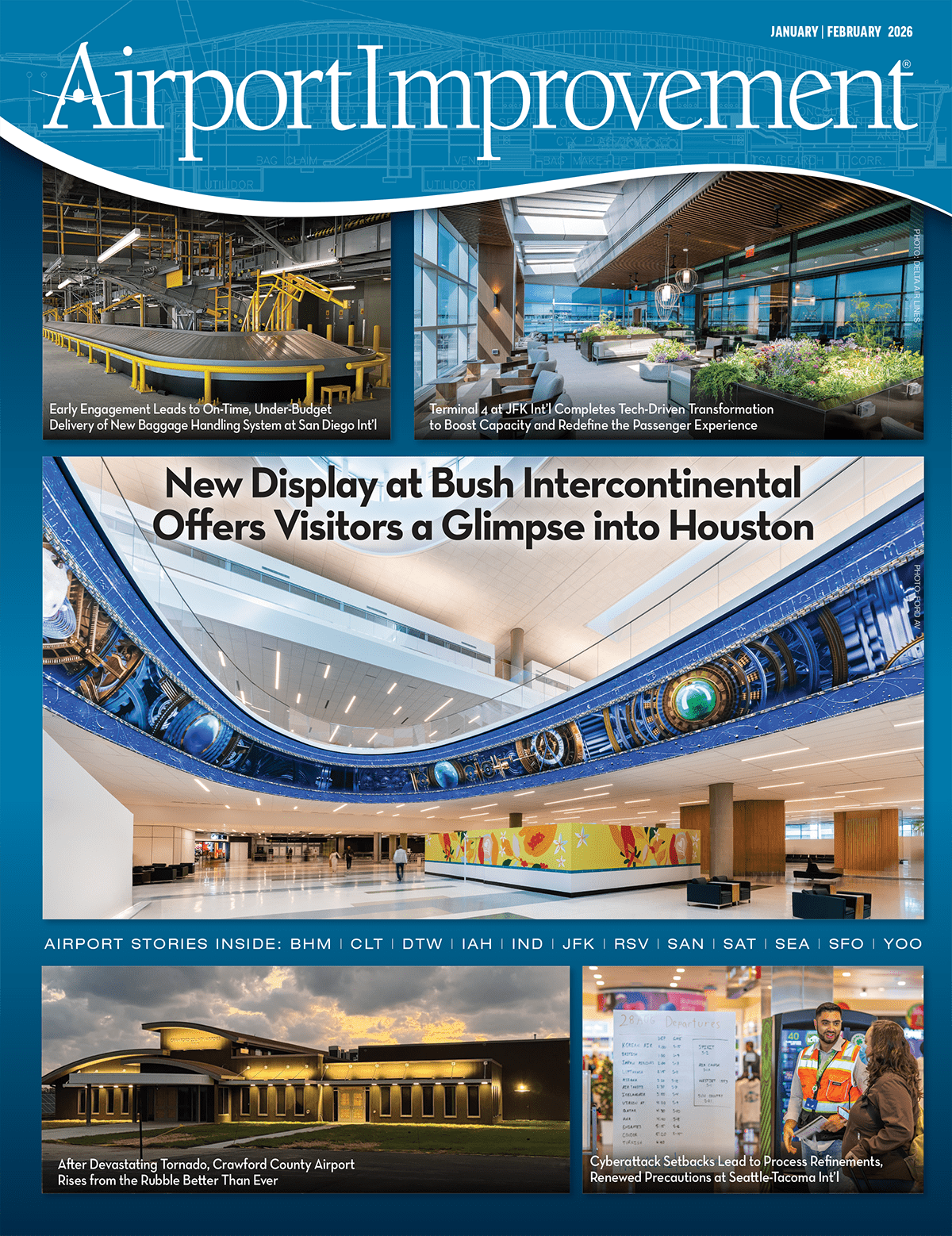

An existing cargo building was converted into the Innovation Factory, with space for entrepreneurs and small businesses.

From NAFTA to Build Back Better

El Paso’s recent economic struggles can largely be traced to the implementation of the North American Free Trade Agreement, or NAFTA, nearly 30 years ago. Many manufacturers outsourced operations to Mexico, where labor costs are a fraction of those in the United States. According to U.S. Labor Department data, El Paso lost 29,000 manufacturing jobs from NAFTA’s 1994 debut through the end of 2016.

“We were never able to rebuild our manufacturing capability,” Choudhuri laments. “The result is we have jobs in the community that barely pay minimum wage, and that is a long-term drag on our local economy.”

Several years ago, Choudhuri and other local leaders sought help from Washington, D.C. to reset El Paso’s fortunes using the advanced research field to create better-paying job opportunities closer to home. They worked closely with Rep. Veronica Escobar, a Democrat who serves Texas’ 16th U.S. Congressional District and is a member of the House Armed Services Committee.

A break came in 2021, when President Biden’s American Rescue Plan introduced the Build Back Better Regional Challenge. Administered through the U.S. Department of Commerce’s Economic Development Administration, the program set out to award a collective $1 billion to numerous regional coalitions to help transform their respective economies through growth in select industry sectors.

The city of El Paso, which owns and operates ELP, submitted its Build Back Better application through the West Texas Aerospace and Defense Manufacturing Coalition, whose other member entities include El Paso County, Workforce Solutions Borderplex, the El Paso Chamber and the Rio Grande Council of Governments. In late 2022, the Economic Development Administration awarded the coalition $40 million in funding. It was one of only 21 winners selected from a pool of nearly 530 applicants.

Almost two-thirds of those federal funds (about $25 million) will go toward development at ELP to support aerospace and defense manufacturing. In a September 2022 press release, Rep. Escobar called the award “an exciting and transformative investment in El Paso’s future and a reshaping of our economic landscape.”

Still, Choudhuri predicts it will take a decade for the benefits of today’s efforts to really take hold. Connecting local manufacturers with larger suppliers will occur in year one, with additional growth to follow in three- to five-year phases moving forward, he explains.

Approaching A Century of Success

Using aviation to spur regional employment—and national defense interests—seems to be part of ELP’s DNA. This autumn will mark the airport’s 95th anniversary, and its genesis was inspired by a visit from one of history’s best-known aviators and modern military pioneers.

Roughly four months after he completed the first nonstop flight between New York City and Paris, Charles Lindbergh piloted the Spirit of St. Louis to El Paso amid his famed “Goodwill Tour” across the United States and Latin America. Encouraged by Lindbergh’s vision of commercial aviation, the El Paso Aero Club immediately began plans for a municipal airport.

The airport that became ELP opened on Sept. 8, 1928—less than one year after Lindbergh’s influential visit.

Over the years, the community’s hoped-for aviation successes came to fruition with some notable milestones. In the late 1960s, ELP became the first U.S. airport to feature a 130-foot-tall control tower, and by 2000 it was the first to operate a Standard Terminal Automation Replacement System (STARS) for air traffic control. That technology has since replaced legacy air traffic control automation equipment at more than 200 FAA and Department of Defense Terminal Radar Approach Control (TRACON) facilities.

ELP’s push to develop adjacent land for non-aeronautical uses was also ahead of the diversification curve. Today, it supports more than 200 commercial businesses and industrial operations, including an air cargo center; light manufacturing; warehousing, distribution and transportation operations; call centers; hotels, retail and restaurants; and two golf courses—all on airport-owned land.

Marmaxx Inc. recently opened a 200-acre distribution center at ELP to support its nationwide network of Marshalls, Homegoods and TJ Maxx retail stores. Today, nearly 3,500 acres of airport land remain available for additional developments, spread over five distinct property districts surrounding ELP. The 601 Corridor offers industrial tenants ready access to railways, highways and the airfield.

Marmaxx Inc. recently opened a 200-acre distribution center at ELP to support its nationwide network of Marshalls, Homegoods and TJ Maxx retail stores. Today, nearly 3,500 acres of airport land remain available for additional developments, spread over five distinct property districts surrounding ELP. The 601 Corridor offers industrial tenants ready access to railways, highways and the airfield.

Rodriguez points to the Innovation Factory and Advanced Manufacturing and Design Center as the latest embodiments of ELP’s forward-thinking mindset.

“It’s been in our strategic plan for the city to use airport development to attract advanced manufacturing,” he says. “We certainly want to be a player in that as an airport, not just for the revenue we get through land leases but also to…generate more air service demand for the region.”

|

A Trans-Border Asset Despite notable non-aeronautical wins outside its airfield perimeter, commercial aviation remains a core focus at El Paso International (ELP). The Texas airport served nearly 3.7 million passengers in 2022, marking a full return to pre-pandemic volume. ELP offers flights to many U.S. destinations with more than 50 departures per day. Though its nonstop lineup touches only 14 markets, seven carriers combine to serve nine of the 10 busiest U.S. airports, allowing for easy one-stop itineraries, both domestic and international. ELP also remains a key hub for troop movements to and from the U.S. Army’s Fort Bliss, and the airport’s robust intra-Texas footprint includes nonstops to Austin, San Antonio, and both major airports in Dallas and Houston. Such air connectivity is vital to a remote community with the closest neighboring large- to mid-sized cities either over the border (Mexico’s Ciudad Juárez) or more than a four-hour drive away (Albuquerque, NM and Tucson, AZ). “We’re lucky in a sense because we have no close competition,” Aviation Director Sam Rodriguez says of ELP’s vast catchment area. “But it’s also unlucky. It certainly tends to drive up fares in our region because there is not a whole lot of competition.” Thanks to its location just north of the Rio Grande River, a good portion of ELP’s passenger base comes from Northern Mexico, particularly cities and towns within the state of Chihuahua. Travelers move north by buses or intra-Mexico flights to Ciudad Juárez’s Abraham Gonzalez International Airport (CJS), then transit the U.S.-Mexican land border before hopping domestic flights from ELP to other U.S. cities. A reverse pattern also holds true. “Inevitably, we function as a two-airport system (with CJS). Their flights go south, and ours go north of the border,” Rodriguez explains. “There are about 500 (U.S.-based) passengers each day who cross the border to use the Juarez airport, and the busiest mass transit route in our city is from the (border) bridge to this airport.” These days, trips through ELP are primarily for leisure travel or visiting friends and relatives on either side of la frontera (the border). But prior to the pandemic, business traffic dominated. Most was from workers who frequently moved between U.S. markets and Ciudad Juárez, which is known for its “maquiladoras”—factories in Mexico run by foreign companies to export products back to their home nations. Rodriguez believes ELP’s industrial expansion will recapture some of its lost business traffic. “The opportunity with this (aerospace and defense manufacturing) initiative and how it translates back to airport operations is pretty significant,” says Rodriguez, who has focused greatly on diversifying ELP’s revenue streams since he became director in the spring of 2020, when COVID was still ravaging air travel. Elizabeth Triggs, director of Economic and International Development for the city of El Paso, also believes recent economic trends favor a further boost in air travel through the region. “We are right on the border, not a couple miles away. So the way El Paso operates has a lot of permeability,” explains Triggs. “This is one of the largest ports for Mexican trade, and with more ‘near shoring,’ Mexico is starting to pick up some of the manufacturing that was overseas. “It so much easier—more predictable, but also less expensive—to make products in Mexico and move them across the U.S. land border rather than depending on China or other countries where the supply chains have not been as consistent over the last couple of years,” she continues. “The airport comes into play because it’s a ton of land that’s easily accessible, from the air or just a bit further south at the Bridge of the Americas.” |