The Mobile Airport Authority moved one step closer to shifting commercial service from Mobile Regional Airport (MOB) to Mobile Downtown Airport (BFM) when it unanimously approved an outside feasibility study about the idea in August. Further assessments, planning and approvals are still necessary to make the idea a reality, but officials are excited about the possibilities of moving airline traffic to the city’s more conveniently located general aviation facility.

“I don’t know of any other example to compare with what we’re doing,” says Authority President Chris Curry. “We’re really disrupting the status quo with our plan to relocate commercial service. Most airports go farther out from the city. We’re bringing the airport closer.”

Currently, passengers traveling into/out of MOB experience significant bottlenecks in street traffic. The proposed initiative would remedy this problem by consolidating commercial service at BFM, which is closer to downtown Mobile and part of the Mobile Aeroplex at Brookley, a mixed-use industrial complex. The move would transpire over several years, with commercial service temporarily occurring at both airports until the shift is complete. Some key general aviation tenants would remain at BFM after the change.

|

facts&figures Project: Feasibility/Planning Study for Relocating Commercial Service Proposed Change: Shift commercial service from Mobile (AL) Regional Airport to Mobile (AL) Downtown Airport Status: Mobile Airport Authority approved feasibility study in Aug. 2018; master plan to follow Study Consultant: VHB Subconsultant: Infrastructure Consulting & Engineering Cost of Study: $99,000 Funding: 90% from FAA Airport Improvement Program; 10% Mobile Airport Authority funds |

If commercial service moves from MOB, space would be made available for new options. Possibilities include moving more businesses into the facility or selling parcels, but those decisions will be made in years to come, says Curry.

Elliot Maisel, chairman of the airport authority board, summarizes the situation this way: “It’s pretty simple. We have a regional airport that is a fantastic facility located in the wrong place. It’s too tough to get there. It’s a vicious cycle: Not enough people go there, thus, there are not enough flights; and so on.”

There has also been a population shift in recent decades, with more people moving to the east of Mobile, closer to BFM, than to the west, where MOB is located.

Maisel believes that shifting service accordingly will provide local travelers with a broader selection of better, cheaper flights, and make Mobile the epicenter of flights into/out of the region.

In a broader sense, the move is expected to foster economic growth in and around Mobile, including downtown. Mayor William S. “Sandy” Stimpson says, “Mobile has a huge opportunity for our city’s quality of life and economic development.” Like airport officials, Stimpson sees the move as a very unique situation. “Even so, it certainly is doable given the circumstances of the two airports. It’s something we’re really excited about,” he says.

Last year, MOB logged about 305,600 enplanements, with service from American Airlines, Delta Air Lines, United Airlines and ViaAir. The Mobile Aeroplex at Brookley, which includes BFM, has no commercial traffic and averages 170 operations per day. It also has about 100 tenants that employ approximately 3,600 people.

Pending changes at the airports relate to broad changes in the region: On the east side of Mobile Bay, the population of Baldwin County is rapidly growing and straining current ground infrastructure. Traffic bottlenecks on the bridge and tunnel that cross the bay have spurred a $2 billion bridge project that is scheduled to begin construction in 2020. The new bridge, which is expected to open in 2025, will speed traffic across the bay while commercial air service moves closer to it.

Such synergy brings significant potential benefits, explains Curry. “A productive airport touches every part of the city,” he says. Curry is confident that a convenient, vibrant commercial airport on the east side of town will help attract new business, boost the potential for increased enrollment and investment in area colleges and universities, and increase fly-in leisure trips to Mobile, given its proximity to Gulf Shore beaches, area theme parks, casinos and cruise attractions.

Such synergy brings significant potential benefits, explains Curry. “A productive airport touches every part of the city,” he says. Curry is confident that a convenient, vibrant commercial airport on the east side of town will help attract new business, boost the potential for increased enrollment and investment in area colleges and universities, and increase fly-in leisure trips to Mobile, given its proximity to Gulf Shore beaches, area theme parks, casinos and cruise attractions.

Before joining the Mobile Airport Authority in 2017, Curry led the re-designation effort at Tallahassee International Airport (TLH).

The Study

Although officials feel the need for change is evident, the process to address it has taken a long time to crystallize. Curry notes that when he joined the airport authority last year, general conversation about an airport reassignment had been going on for about 20 years. The Mobile community began questioning whether it had commercial service at the right airport, he explains. Several new members subsequently joined the airport authority board, and soon discussions “heated up.”

Conversations among the board, authority staff, mayor’s office and FAA led airport officials to commission a feasibility study. The purpose was to obtain outside expertise and professional data to answer the question that had been circulating through the region. The Mobile Airport Authority Board selected VHB in a competitive bid process and received an FAA Airport Improvement Program grant that funded 90% of the $99,000 study.

VHB conducted the study in 120 days, and work began in February 2018. The firm delivered results to the airport authority that spring, and the findings were announced in August. It was an unusually short timetable for a study of this kind, says Fin Bonset, VHB’s manager of Airport Planning. In essence, it was about striking while the iron was hot, explains Bonset.

VHB conducted the study in 120 days, and work began in February 2018. The firm delivered results to the airport authority that spring, and the findings were announced in August. It was an unusually short timetable for a study of this kind, says Fin Bonset, VHB’s manager of Airport Planning. In essence, it was about striking while the iron was hot, explains Bonset.

Among other things, VHB’s research revealed two notable findings: 1) an impressive level of local community support among stakeholders such as the business community, regional companies and the Mobile Area Chamber of Commerce; and 2) a surprising amount of market leakage resulting from the current commercial service location.

Leakage occurs when Mobile area passengers use Pensacola International Airport or Gulfport-Biloxi International Airport to avoid traffic congestion to and from MOB. According to the research, MOB is currently capturing just 53.8% of its market, notes Bonset.

The study found that shifting commercial service to BFM would cut drive time and move service closer to more than 138,000 potential passengers. In addition, doing so would increase the likelihood of BFM capturing significant portions of the remaining 46.2% of the local market. Because the overall market is growing and drawing more passengers, adding new routes is projected to increase enplanements, revenue and competition, which in turn, is likely to reduce airfares.

Other key findings of the study include “great interest from low-cost carriers” such as ViaAir to provide service from BFM and potentially significant economic and fiscal impact from the project, pending current economic trends.

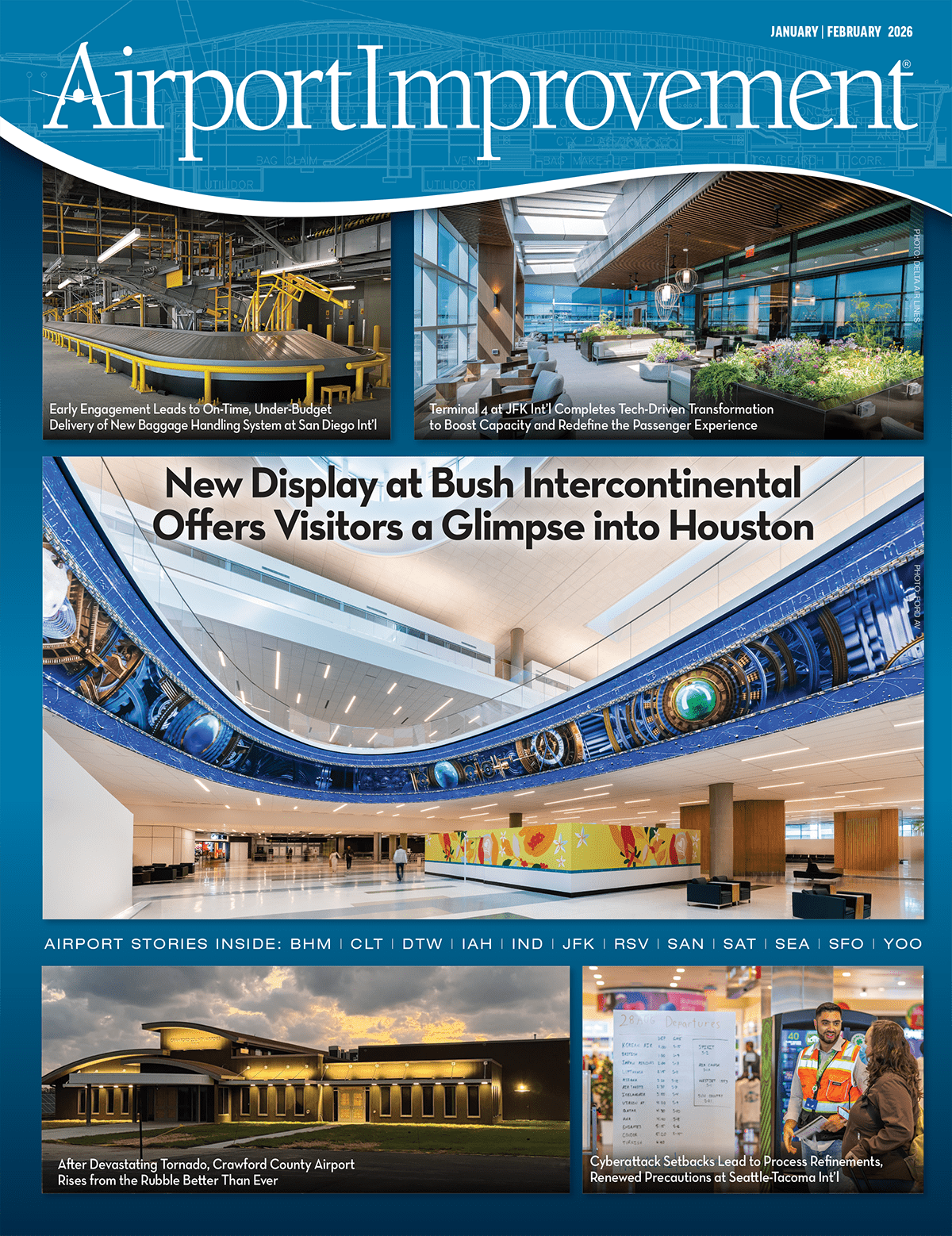

Mobile Downtown Airport (pictured) may soon handle commercial traffic currently at Mobile Regional Airport.

Regarding fiscal impact, the study projects that relocated and expanded commercial air service at BFM would generate net tax benefits to the county, county schools, city of Mobile and state of Alabama that would almost double over the next 20 years, from the current total of $951.1 million to $1.8 billion.

At this stage in the process, total costs have not been determined for moving commercial service from MOB and converting BFM accordingly. Bonset estimates expenses could run from $100 million to $160 million, but the payoff could be in the billions for the local/regional economy and the airport system.

A Tale of Two Airports

It all boils down to maximizing service for the community and maximizing revenue, says Bonset. The increased flight volume from area defense contractors alone could add millions of dollars each year to airport revenue, he notes. The move would also boost non-aeronautical revenue from increased business at the nearby industrial park, he adds.

In addition to studying the option of moving commercial service to BFM, the airport authority explored the possibility of making MOB more accessible and enhancing commercial service there. Working as a subconsultant to VHB, Infrastructure Consulting and Engineering studied the MOB accessibility issue.

“We looked at the best ways to commute, and you would need a limited access roadway,” says company Vice President Doug Hambrecht, noting such a project would entail years of costly work. BFM already has good interstate access, he adds.

The next step in the initiative, development of a master plan, will provide more details. Curry reports that the airport authority expects to start the master plan before the end of 2018, and the process, which could be funded with another FAA grant, may take one to two years to complete. Among the associated possibilities: re-designating BFM as an international airport.

Plans & Potential

More business means more air travel, and vice versa. As such, Maisel and Curry point out that there is a gathering development scene in the Mobile area. Highlights include a $30 million Amazon sorting center that opened in 2017, and Walmart’s new $135 million distribution facility, which opened in August 2018.

More business means more air travel, and vice versa. As such, Maisel and Curry point out that there is a gathering development scene in the Mobile area. Highlights include a $30 million Amazon sorting center that opened in 2017, and Walmart’s new $135 million distribution facility, which opened in August 2018.

Business is also booming at BFM and its associated industrial park. Among other companies, VT Mobile Aerospace Engineering, a tenant since 1991, recently expanded to 900,000 square feet of space; Airbus North America Manufacturing opened a 1 million-square-foot factory in 2015; and MAAS Aviation opened facilities there in 2017.

Current activity at the $600 million facility Airbus opened at BFM in 2015 also is telling: The 1 million-square-foot assembly plant turns out an average of four A-320 passenger aircraft per month. Curry predicts that number could eventually increase to double digit growth.

Early this year, Airbus officials announced that the company is studying a boost in A-320 production at BFM to six aircraft monthly. They were joined by Bombardier officials for a joint announcement of plans to add a second assembly line, for Bombardier C series jetliners, at BFM. According to company officials, the increased production would add a combined 600 jobs.

That number of new workers would be a significant boost to BFM. Currently, 3,600 workers are employed at the industrial park by a range of significant tenants that include Continental Motors, Federal Express and Honeywell, among others. The point, as noted by VHB: boosting economic growth more broadly fuels additional air travel.

A Harbinger of Future Expansion

In addition to beginning the master plan process, the airport authority is in the design phase for a shorter-term project to pave the way for larger changes. The project: renovating a BFM building now used by Airbus into a passenger terminal to service ViaAir. Curry says the renovated terminal may be ready by May 2019, at which time Via Air will transition its service there, initially sharing space with Airbus.

Stimpson says the project is a “tangible step to show we’re committed, and moving commercial air service is doable.” He believes that 10 to 20 years from now, there will be bustling commercial activity at BFM that operates in harmony with current tenants such Airbus and VT Mobile Aerospace Engineering. “It will be good for the companies and Mobile,” he asserts.

Stimpson says the project is a “tangible step to show we’re committed, and moving commercial air service is doable.” He believes that 10 to 20 years from now, there will be bustling commercial activity at BFM that operates in harmony with current tenants such Airbus and VT Mobile Aerospace Engineering. “It will be good for the companies and Mobile,” he asserts.

For now, much work remains for the overall initiative. Yet officials are optimistic about the potential. “This is a transformational project,” emphasizes Curry. “And in order to transform communities, sometimes you have to disrupt the status quo. We’re doing that in a novel way: Instead of bringing even greater numbers of people to the airport, we are bringing the airport to the people.”