Big changes are underway at Tweed-New Haven Regional Airport (HVN), and even bigger changes are in the works. Current projects include $5.2 million of improvements, most notably the addition of modular buildings to provide space for a 300-seat holdroom and a new ticketing area.

Big changes are underway at Tweed-New Haven Regional Airport (HVN), and even bigger changes are in the works. Current projects include $5.2 million of improvements, most notably the addition of modular buildings to provide space for a 300-seat holdroom and a new ticketing area. The small Connecticut airport is also relocating its baggage claim area into what is now the administration building, and updating the security checkpoint, which will remain in its existing location.

The flurry of improvements is to accommodate new service from Avelo Airlines that is scheduled to begin in early November. “We have a two-gate terminal, and we are going to have five flights, sometimes three, a day,” explains HVN Executive Director Sean Scanlon. “We need more space.”

The flurry of improvements is to accommodate new service from Avelo Airlines that is scheduled to begin in early November. “We have a two-gate terminal, and we are going to have five flights, sometimes three, a day,” explains HVN Executive Director Sean Scanlon. “We need more space.”

The new modular buildings and other changes will help HVN handle the increased traffic volume and more pronounced surges inside the terminal. “American Airlines flies with 75 seats, and Avelo will use Boeing 737s with about 140 seats,” Scanlon specifies. American, which flew Embraer 175s to Philadelphia International, ended that service on September 30. It was the only flight remaining between the two cities from pre-pandemic days.

|

facts&figures Current Project: Terminal Expansion/Renovations Location: Tweed-New Haven (CT) Regional Airport Owner: New Haven Regional Airport Authority Operator/Manager: Avports Master Plan Consultant: McFarland Johnson Key Improvements: Addition of modular units for 300-seat holdroom & ticketing area; relocating baggage claim; updating security checkpoint Cost: $5.2 million Funding: $1.2 million from Avelo Airlines; $4 million loan from Avports that will be forgiven if company & airport authority reach new management agreement Construction: Mid-Sept. 2021-Dec. 2021 Design: PGAL Construction: Walsh Construction Catalyst for Current & Future Improvements: New commercial passenger service to 5 Florida airports by Avelo Airlines; additional business destinations are anticipated next year Next Phase: New Terminal & Runway Extension Environmental Assessment: Currently underway New East Terminal: 78,000 sq. ft., with 4-6 gates (to replace current West Terminal) Design: PGAL Construction: Timeline to be determined Funding: Avports Runway Extension: From 5,600 ft. to 6,635 ft. Other Key Component: Runway safety areas Construction: Timeline to be determined Funding: FAA grants; Avports Of Note: 2 neighboring communities stopped runway extension for more than a decade; in March 2020, U.S. Supreme Court upheld ruling of lower court to overturn state law that prevented runway project; Avports will invest $70 million in runway extension & new terminal if new operating agreement is reached with airport authority |

Avelo, a new ultra-low-cost carrier, is providing direct service from HVN to five Florida cities: Fort Myers, Palm Beach, Tampa, Fort Lauderdale and Orlando. In an unusual move for the carrier, it is investing $1.2 million to upgrade HVN’s terminal facilities. Avports, the long-time private operator at HVN, is funding the remaining portion of current terminal improvements with a $4 million loan that will be forgiven if Avports and the airport authority reach a new management agreement. The company’s current agreement expires in 2024.

Larger and longer-term improvements being discussed include building a new terminal to replace the one being expanded and extending HVN’s runway. Airport plans to invest $70 million to make these projects a reality, but not until its new management contract is finalized. The city of New Haven, which owns the airport, took an important step closer to sealing the deal in late September, when it approved a new 43-year lease to the New Haven Regional Airport Authority. In mid-October, the authority and Avports were hoping to wrap up negotiations on a new operating agreement by November.

Avports has managed HVN for 22 years and is now a unit of West Street Infrastructure Partners III, an infrastructure investment fund managed by Goldman Sachs & Co. Last May, the pair announced plans for a long-term investment of $100 million via a public-private partnership to breathe new life into the little-used airport. At the same time, Avelo announced it was making HVN its East Coast hub and would be hiring 100 employees, including pilots, for its new base in Connecticut.

Current improvements to HVN’s existing West Terminal began on Sept. 20 under the supervision of Avports. Project officials expect the work to be completed in December. The Houston office of PGAL designed the project, and Walsh Construction is the general contractor.

Avports also selected PGAL to design a new East Terminal for the airport.

New Terminal, Longer Runway

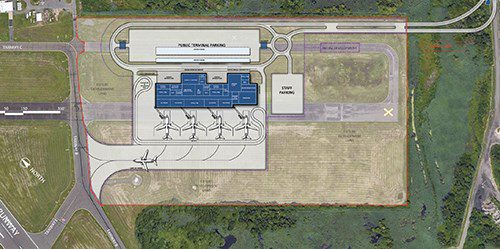

Earlier this year, FAA approved the master plan McFarland Johnson developed for the airport. Key components include extending the 5,600-foot runway to 6,635 feet, abandonment of the little-used crosswind runway and constructing a new 78,000-square-foot terminal.

Scanlon notes that a longer runway will allow HVN to handle larger aircraft. Given the airport’s location near marshes and the Long Island Sound shore, project designers will need to maximize the limited available land for the runway extension and accompanying safety zones.

Preliminary plans for the new terminal, dubbed the East Terminal, include four to six gates and concessions. While the holdroom capacity has not been determined yet, the new terminal will contain two TSA security lanes, just like the existing terminal.

The East Terminal will be built on the eastern end of the existing crosswind runway. Portions of the old runway will be converted into a taxiway and ramps linking to the extended runway.

Shifting the location of HVN’s terminal will affect vehicle traffic in two communities because the airport straddles the official boundary that separates them. Currently, airport visitors drive through a residential area of New Haven to reach the West Terminal. When it closes and the new East Terminal opens, visitors will enter through a commercial area of East Haven. Scanlon notes that customers will simply use a different exit from Interstate 95 to access the airport.

To get the ball rolling on design work for the new terminal and runway extension, Avports is underwriting costs for the associated environmental assessment study. Airport officials expect the projects to require environmental mitigation measures and have included such work in the planning and construction timeline. Overall, they expect the environmental assessment to take one year, and building the terminal and runway to take two years.

Funding availability will determine the order of construction. The runway extension will be eligible for FAA funds, but the terminal project will not.

Scanlon says the airport does not have a plan for the West Terminal once the East Terminal opens, but it will consult neighbors about various options.

Contentious Backstory

For more than a decade, New Haven and East Haven joined forces to prevent the extension of HVN’s runway. Primary concerns include aircraft noise and the presumed pollution of nearby waterways. A 2009 agreement that codified the municipalities’ opposition was later incorporated into state law. After former New Haven Mayor Toni Harp failed at repealing the law, the airport authority went to court. Eventually, the case ascended all the way to the nation’s highest legal venue. In March 2020, the U.S. Supreme Court upheld a previous ruling that overturned the state law.

“For the first time in 10 years, we were able to do what we wanted to do and were allowed to masterplan an expansion,” Scanlon reports.

Critics of the runway project point to the $1.8 million that HVN receives from the city and state as proof that the airport is not economically viable. Scanlon, in turn, explains that HVN has been hamstrung and not able to build the infrastructure it needs to attract airlines that would pay the bills.

“I am constantly talking to either residents, politicians or different stakeholders to craft a community benefits package that will offset the impact of the expansion,” he says. “It is a daily dialog and discussion.”

To help keep peace with HVN’s neighbors, Avports has committed to funding a $5 million community benefits package. Although details about the package have not been released, Scanlon sees some signs that sentiment toward the airport may be changing. For instance, the mayors of New Haven and East Haven attended the press event last May when Avports announced its plans to invest $70 million in airport improvements.

In addition to his daytime job as the airport director, Scanlon is also a state representative in Hartford representing the two shore towns directly east of East Haven.

The Big Proposal

When McFarland Johnson delivered HVN’s master plan in March, the airport authority did not have a ready source of funding to pay for the local share of project expenses. “We don’t have a revenue stream,” explains Scanlon. “We don’t have anywhere near the amount of PFC funds needed that we could tap.”

As a result, Avports presented the unsolicited offer to fund HVN’s capital improvements to the tune of $70 million.

“We have been part of this community for so long that we wanted to continue to be part of the community for the long term,” says Jorge Roberts, chief executive officer of Avports. “We wanted to see the airport be a success, and they needed to have access to capital to do so.”

“We have been part of this community for so long that we wanted to continue to be part of the community for the long term,” says Jorge Roberts, chief executive officer of Avports. “We wanted to see the airport be a success, and they needed to have access to capital to do so.”

Roberts describes the pending management agreement as an expanded relationship. “We are working to solve a challenge that the airport faces—an infrastructure challenge,” he explains. “We are providing the necessary capital and taking the risk.”

With the agreement and attendant investment from Avports, the city and state would no longer subsidize HVN.

Under the current management agreement, the airport authority pays Avports a management fee and covers the salaries of employees the company posts at HVN.

In the pending agreement, “who pays who has not been finalized or revealed,” notes Scanlon. Other details that have not been decided include which party has the final go/no-go decision on the terminal expansion and other key issues.

That said, a company spokesman notes that Avports will have the final decision on proceeding with its investments.

Avports will self-finance the capital projects and not go to the bond market, he adds.

Scanlon explains that the airport authority is leasing portions of HVN to Avports for development, but the authority is retaining ownership to remain eligible for FAA funding.

The proposed agreement is for 43 years. Roberts notes that the first three years cover the period of the company’s investment for the environmental assessment and subsequent construction; and the final 40 years enable Avports to recover its investment.

Overall, Avports has been managing airport operations for 94 years. Its longest existing relationship, 50 years, is with the Port Authority of New York and New Jersey to run Teterboro Airport. The company has operated West Chester County Airport in New York for 43 years. Currently, it manages 10 airports.

Roberts describes the proposed investment in HVN as “our most involved in recent history” and points out that the company is stepping forward to transfer risk from the airport to Avports. “With that comes additional responsibility as well,” he says.

The agreement—a public-private partnership—could serve as a model for future investments in other regional airports, he adds.

While airports elsewhere in the world have involved the private sector for more than 30 years, public-private partnerships are not as common at U.S. airports. Roberts theorizes that U.S. airports have not explored such partnerships because most have enjoyed ready access to capital. However, more airports are now “challenged” to get the resources needed to grow and may begin considering them.

Avports and others may step in more often to provide the capital airports need to grow and attract the air service that is vital to their respective communities.

“If we can make this work and get it off the ground, I have no doubt it will serve as a model for others,” says Scanlon. “I think we will have more PPPs for those airports that don’t have the funding capacity.”

Roberts, who joined Avports in 2019, was previously with Carlyle Airport Group and was involved in the redevelopment of Terminal One at John F. Kennedy International Airport.

He says the runway at HVN needs to be extended so the airport can be economically viable and remain a valuable resource for the community. “Part of our business plan recognizes that the airport has the potential to be viable and potentially profitable,” Roberts explains. “If the issues that have hindered the airport are resolved, as a private investor we should be able to recover the capital. If it were not viable, we would be very hard-pressed to make a case for an investment.”

Air Service Development

HVN started recruiting Avelo in August 2020. The airport negotiated rates and charges for the carrier, but did not “pay them to come here,” Scanlon specifies.

Avelo has been assembling a point-to-point network of un-served and underserved communities where travel convenience is a big factor.

Currently, the airport authority pays for an air service development consultant through Avports. ASM is the airport’s consultant.

Going forward, Scanlon says air service development will be a “combination of roles for each that still have not been publicly defined.”

The catchment area for HVN includes 2 million potential passengers. Geographically, it spans from Strafford, just east of Bridgeport, to Middleton, which is south of Hartford.

Scanlon explains that most passengers from the New Haven area travel to New York airports rather than going up to Bradley International Airport, located just south of the Connecticut/Massachusetts state line.

Consumer preference studies have indicated that the top destinations for HVN’s catchment area include three Florida cities, the Midwest and the West. Previously, travelers had to fly through Philadelphia to reach any of these destinations.

Conversations with businesses in the New Haven area—particularly those in education, healthcare and biotech—indicate that a lack of air service hampers their recruiting efforts, adds Roberts.

While Avelo is initially serving tourist stops in Florida, Scanlon expects the carrier to add business-oriented destinations such as Chicago and Washington, D.C. in the second quarter of 2022.

With the departure of regional jet service by American Airlines, Roberts does not anticipate any legacy carrier to return to HVN until the new terminal is completed. “During this interim, we intend to work with Avelo to try to serve as much as possible the needs of the business community,” he says.

Avelo was founded by Andrew Levy, a former executive with United Continental Holdings and Allegiant Air. Levy acquired Xtra, a charter operator, in August 2018, and subsequently converted it into a low-cost scheduled carrier flying B737s. Renamed Avelo Airlines, the carrier began flights out of Hollywood-Burbank Airport this April to West Coast destinations. Company officials note that Avelo is the first new mainline carrier in 15 years.

Given the recent history of start-up airlines, Scanlon is not concerned that Avelo may fail before improvements are completed at HVN.

“I trust Levy and his skills,” says Scanlon. “He has a good track record at Allegiant. I believe in him, and I believe it will work.”