Consider “Inspansion” During COVID-19 Recovery

The aviation industry has historically experienced financial shocks in roughly 10-year cycles: airline deregulation in 1978, the Gulf War in 1990, 9/11 terrorist attacks in 2001, the financial crisis in 2008, and now COVID-19. All of these events had a significant impact on airport operations and future development plans.

|

David Tomber director of strategic planning for Woolpert, is an industry veteran with more than 35 years experience focused entirely on aviation. He is a subject matter expert on airport facility planning strategies for development and operations to optimize capacity and financial benefits. |

While I am confident that the industry will bounce back stronger than ever with time, we need to deal with the immediate impacts of this financial shock now. COVID-19 is forcing airports and their airline partners to develop creative ways to reduce operational and development costs while maintaining great passenger service with limited financial resources. We also need to consider when traffic will bounce back and what the long-term growth trend might be.

After the 9/11 terrorist attacks in 2001, I coined the term “inspansion” while serving as the aviation planning manager at Seattle-Tacoma International Airport (Sea-Tac). Inspansion describes a method of adding capacity through creative analytics in lieu of more costly physical expansion. It uses process re-engineering, operational process improvements, technology, staffing and peaking to optimize facility performance and defer expensive “brick-and-mortar” capital investments. Many airports focus on glamorous new capital development projects rather than the potential opportunity of optimizing resources—not just from a financial standpoint, but also from an environmental standpoint for sustainability. Essentially, there are two shades of green: financial and environmental.

Inspansion for airports is based on principles of leveraging excellence in business management practices, operations and technology to set strategic direction. This will result in greater efficiency, flexibility and capacity while reducing costs and providing a higher level of service. Non-visible process redesign based on analytics supports this new paradigm.

While at Sea-Tac, I analyzed the benefits of inspansion, and the results were significant. Using non-traditional inspansion planning and business intelligence principles could result in an initial capital expense that was 20% of the cost using traditional planning principles. And 30-year total cost of ownership in the same analysis was 150% of the initial capital expense for capital development. Using inspansion principles, the 30-year total ownership cost was approximately 83% less. Not only did inspansion strategies reduce cost at equal or greater level of service, they also offered a way to make incremental improvements responding to changing market conditions.

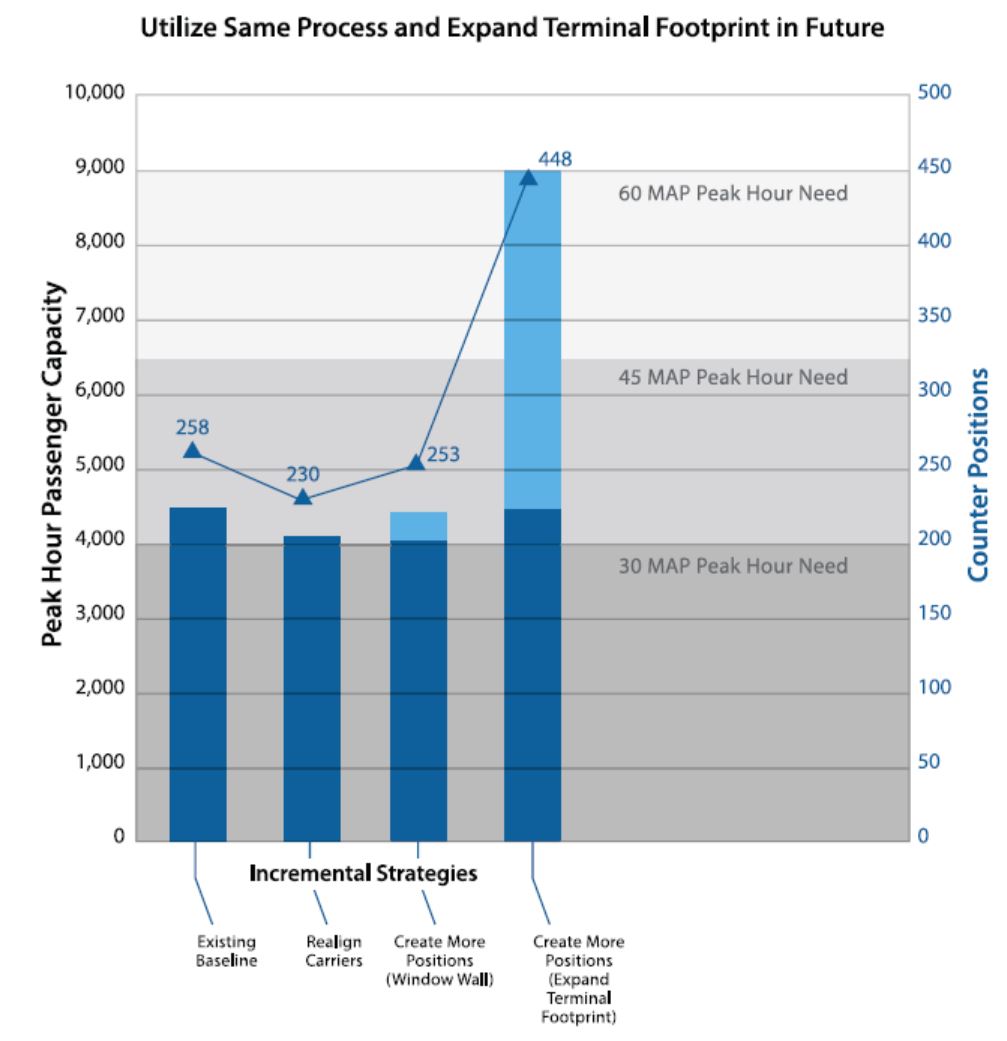

In the popular vernacular of COVID-19, inspansion principles were an effective strategy to “flatten the curve” of passenger processing, as demonstrated by the blue lines in graphs below.

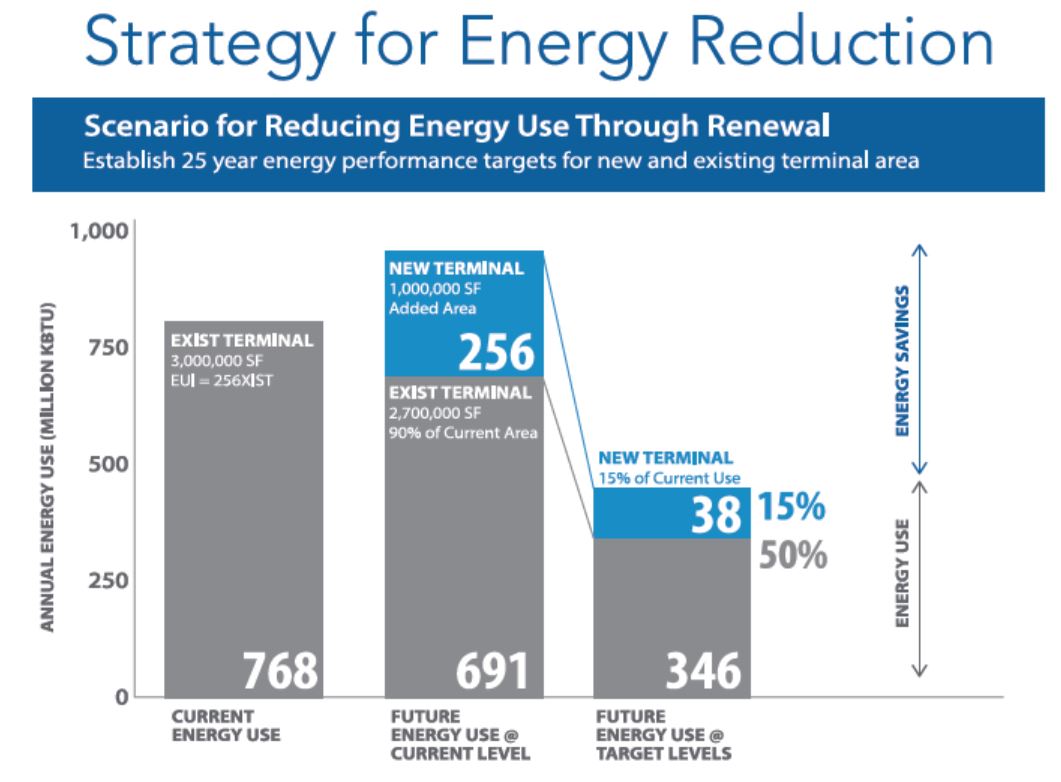

Inspansion strategies can also be used to reduce energy and greenhouse gas emissions with a smaller footprint. The 50-year energy impact of a terminal building is approximately 80% operational and 20% embodied in manufacture, transport and construction. At Sea-Tac, inspansion showed how energy use could be significantly reduced. The baseline terminal complex had an energy use intensity index (EUI) of 768 kbtu per square foot annually. Energy use at the current level would have increased annual EUI to 947. Energy reduction and inspansion strategies, however, had the potential to reduce annual EUI to 384, or 50% of current use with only a minimal footprint expansion for an increase in passenger traffic from 40 million annual passengers to more than 60 million annual passengers.

Smart management of facility assets offers tremendous economic value for maintenance, operations and replacement of aging systems. Ongoing legacy costs can be several times the initial cost of construction. The average weighted design life of terminal systems is approximately 30 years. The current replacement value of terminal assets might represent 50% of an airport’s asset portfolio; however, the 20-year renewal expense for a terminal might exceed 70% of asset portfolio. Using quantitative analysis, strategies can be developed for replacing parts rather than entire systems, adjusting maintenance practices, or stretching design life by “sweating” assets to defer renewal expense.

Airports and their airline and concession partners are driven to optimize financial performance at all times, but particularly during and after major financial shocks. As the entire industry works to recover from the damage caused by COVID-19, consider leveraging the principles of inspansion. The economic value can be tremendous.

David Tomber

director of strategic planning for Woolpert, is an industry veteran with more than 35 years experience focused entirely on aviation. He is a subject matter expert on airport facility planning strategies for development and operations to optimize capacity and financial benefits.

FREE Whitepaper

PAVIX: Proven Winner for All Airport Concrete Infrastructure

International Chem-Crete Corporation (ICC) manufactures and sells PAVIX, a unique line of crystalline waterproofing products that penetrate into the surface of cured concrete to fill and seal pores and capillary voids, creating a long lasting protective zone within the concrete substrate.

Once concrete is treated, water is prevented from penetrating through this protective zone and causing associated damage, such as freeze-thaw cracking, reinforcing steel corrosion, chloride ion penetration, and ASR related cracking.

This white paper discusses how the PAVIX CCC100 technology works and its applications.